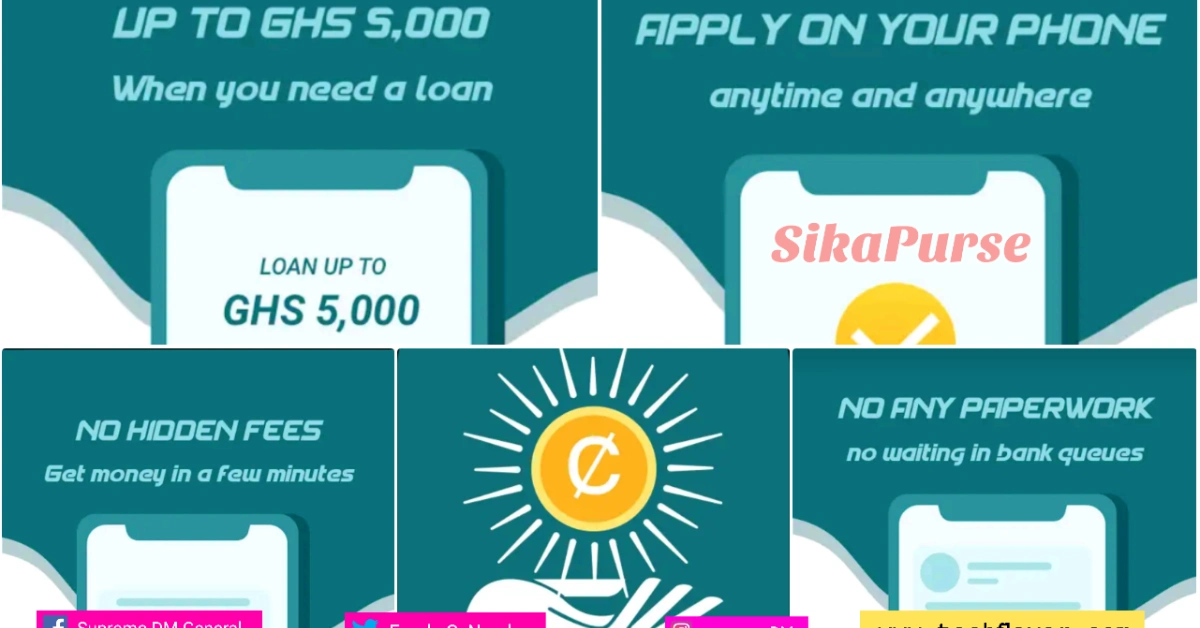

SikaPurse offers a range of credit solutions. SikaPurse is simple to download and use to submit an online loan application in Ghana. Since we live in a digital age, many lenders do business with borrowers without using paper.

As a result, the days when borrowers had to wait in lines at banks to obtain loans are long gone. They can do that right now while relaxing in their own houses.

:-This article contains complete information on how to apply for a SikaPurse loan, including prerequisites and loan terms.

How To Apply For The SikaPurse Loan?

Any loan you want requires you first to apply. To utilize:

- Install the SikaPurse app.

- Create a profile

- Complete the form, then submit it.

- Apply on the web

- Directly deposit the loan into your bank account.

Increase your credit limit and cut your interest rate by paying off your obligations on time or completing tasks.

What Are The Requirements For The SikaPurse Loan application?

Before applying for any loan, you must fulfil several prerequisites. Before choosing which candidates to grant loans to, lenders always ensure they match requirements. SikaPurse loan conditions include the following:

- You have to be from Ghana.

- You must be able to pay your monthly bills (Be a worker)

- You should submit your application using your Ghanaian documentation, such as your Ghana voter ID.

- Must be between the ages of 22 and 55.

What Are The Minimum And Maximum Loan Amounts of SikaPurse Loan?

You should know how much you can borrow because you are looking for loans to help you with your financial demands. Lenders offer different loan amounts to borrowers. They provide loans starting at GHC 2,000. However, they only give loans up to Gh5,000.

What Is The Loan Term of SikaPurse Loan?

Make sure you understand the loan term before borrowing money from any lender. The shortest borrowing period is 90 days, while the longest is 365 days (the longest).

What Is The Interest Rate On SikaPurse Loans?

Every lender, including Sikapurse, sets a different interest rate for each loan that it extends to borrowers. The interest rate on sikapurse loans ranges from 8% to 25% annually.

What Are The Benefits of SikaPurse Loan?

They offer various advantages to borrowers who take out loans from them. They consist of the following:

- You may borrow up to GH 5000 from them.

- Your payment tenure is an option.

- It is trustworthy, safe, and adaptable.

- There are no additional fees.

- They deliver a credit determination.

- Every day of the week, they are available to you at all times.

Also Read:-

How To Repay The SikaPurse Loan?

You consent to timely loan repayment when you take a loan from them. This will improve your chances of obtaining a loan from them or any other lender. Additionally, your credit score will suffer if you don’t pay back your loan.

Let’s look at how you can pay back your SikaPurse loan now:

- Launch the loan application. You will notice “Repayment” once you are in the SikaPurse Loan application. Please press that button.

- They will display the amount you need to pay on the following page. Then, select “Repay Now” to continue.

Note: For the time being, Sikapurse only takes offline payments as a form of loan repayment.

Why Are People Now Moving To SikaPura Loan?

Due to the reasons listed below, ika purse is subtly becoming one of the top lending platforms in Ghana.

- There are no additional fees associated with Sika Purse loans.

- Yes, you may borrow up to GHS 5000. You can.

- Sika Purse loans provide customizable payment terms that let you decide how long you wish to take to pay off the loan.

- Sika bags are highly dependable and safe.